Qualified Dividends And Capital Gain Tax Worksheet 2020

Capital gains and qualified dividends. Complete the rest of Form 1040 1040-SR or 1040-NR.

Qualified Dividends And Capital Gain Tax Worksheet Line 44 Promotiontablecovers

Qualified dividends and capital gain tax worksheet line 11a.

Qualified dividends and capital gain tax worksheet 2020. Go to wwwirsgovScheduleD for instructions and the latest information. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions. Schedule DForm 1040 2020.

Qualified dividends and capital gains. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR line 16 or in the instructions for Form 1040-NR line 16 to figure your tax. The amount of qualified dividends used in the calculation of additional 10 tax withholding or alternative minimum tax is also shown on this worksheet.

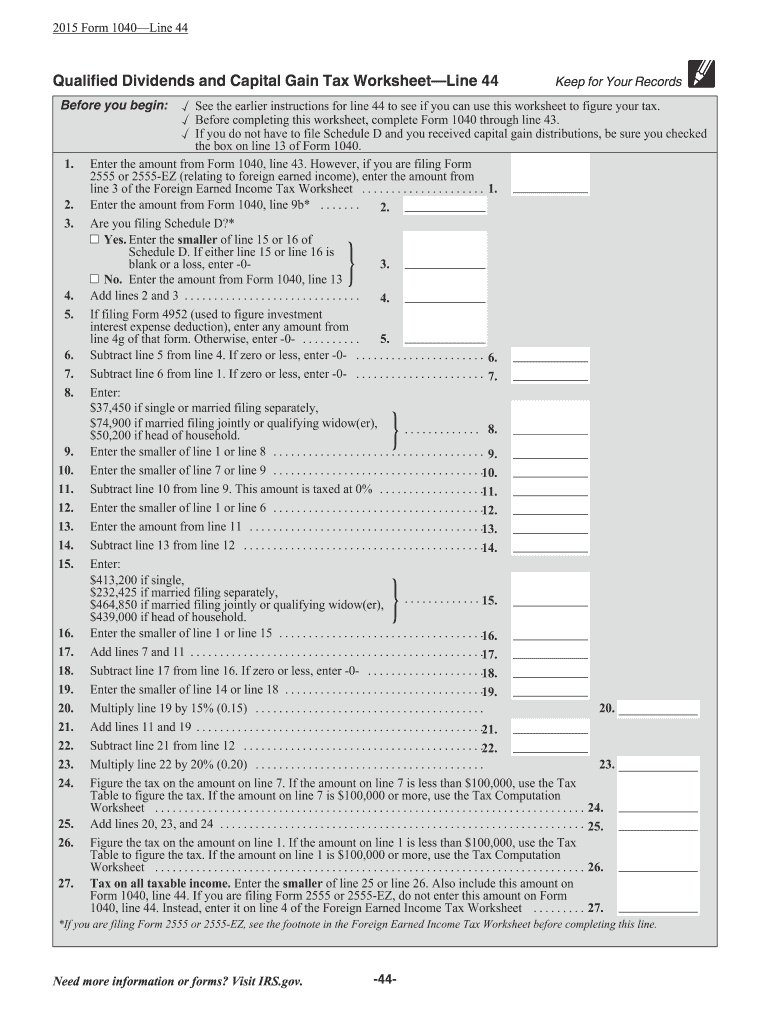

Exclusion of Gain on Qualified Small Business QSB Stock later. Maximum capital tax gains rates were decreased from eight or ten percent to 5 percent because of the Jobs and Growth Tax. Lines 15-19 are for the 15 bracket qualified income.

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. The 0 rate applies to amounts up to 2650. However many use Schedule D for lower capital gains tax rates.

Lines 12-14 are for qualified taxable income. Notice to Shareholder of Undistributed Long-Term Capital Gains 2020. Names shown on return.

Keep for Your Records. Qualified dividends and capital gain tax worksheet. This is actually the biggest class of forms in IRS.

The 500 of qualified dividends shown in box 1b of Form 1099-DIV are all qualified dividends because you held the stock for 61 days of the 121-day period from July 16 2020 through September 14 2020. Before completing this worksheet complete Form 1040 through line 10. Qualified Dividends Capital Gains Worksheet Worksheet Resume Examples.

If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-. List of Qualified Dividends And Capital Gain Tax Worksheet 2020. Qualified Dividends and the Capital Gain Tax Worksheet.

The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Lines 1 7 are for ordinary income and qualified income. The qualified dividends worksheet is found on the back of page 2 in the 1040 instructions booklet just above the schedule 1 form 1040 line 9b amount worksheet.

Undistributed Capital Gains Tax Return 1220 11302020 Form 2439. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. April 1 2020 by Timmy Jui.

Qualified income is the sum of long term capital gains and qualified dividends minus anything you decided to take as income on form 4952 don t do that. Lines 8-11 are for non-taxable qualified income. Capital Gains and Losses and Built-in Gains 2020 12222020 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2020 01122021 Form 2438.

December 16 2020 Others. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. 22 Do you have qualified dividends on Form 1040 1040-SR or 1040-NR line 3a.

Before completing this worksheet complete form 1040 through line 43. Qualified dividends and capital gain tax worksheet 2020. FDIA0612L 1223 Albert T.

If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. You held the stock for 63 days from July 16 2020 through September 16 2020. The 27 lines because they are so simplified end up being difficult to follow what exactly they do.

The maximum tax rate for long-term capital gains and qualified dividends is 20. In this worksheet we are going to define how to get relaxation from Schedule D. Capital Gains and Losses Attach to Form 1040 1040-SR or 1040-NR.

Lines 1-7 are for ordinary income and qualified income. Qualified dividends and capital gain tax worksheet. Qualified Dividends Capital Gain Worksheets Worksheets Samples.

IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. For tax year 2020 the 20 rate applies to amounts above 13150. Instead 1040 Line 44 Tax asks you to see instructions In those instructions there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet which is how you actually calculate your Line 44 tax.

For Forms 1040 and 1040-SR line 16. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

Qualified Dividends and Capital Gain Tax WorksheetLine 11a.

2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gains Worksheet

Qualified Dividends And Capital Gains Worksheet 2019

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 Fill Online Printable Fillable Blank Pdffiller

Capital Gains Tax Worksheet Nidecmege

2018 Qualified Dividends And Capital Gain Tax Worksheet Pdf Qualified Dividends And Capital Gain Tax Worksheet 2018 U2022 See Form 1040 Instructions For Course Hero

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

Instructions Comprehensive Problem 2 1 Beverly And Chegg Com

Instructions Schedule Schedule 5 Qualified Dividends Chegg Com

Qualified Dividends And Capital Gain Tax Worksheet 2016 Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Course Hero

Qualified Dividends And Capital Gains Worksheet

Qualified Dividends And Capital Gains Worksheet 2021

Amt Qualified Dividends And Capital Gains Worksheet Promotiontablecovers

Qualified Dividends And Capital Gains Worksheet

Capital Gains Tax Worksheet Nidecmege

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Out And Sign Printable Pdf Template Signnow

2019 Form 1040 Qualified Dividends And Capital Gain Tax Worksheet 2021 Tax Forms 1040 Printable

2018 Qualified Dividends And Capital Gain Tax Worksheet Pdf Qualified Dividends And Capital Gain Tax Worksheet 2018 U2022 See Form 1040 Instructions For Course Hero

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller